Yesterday, Consumerism Commentary reader Ryan suggested I write about interest-only mortgages.

There is no such thing as an “interest-only mortgage.” Wouldn’t that be nice, though, to have a mortgage that did not require you to pay any principal back to the lender? Unfortunately, when you become a borrower, your lender will insist upon receiving interest payments as well as principal at some point. What does exist, however, is an interest-only payment option for mortgages. The interest-only payment option can apply to adjustable-rate mortgages and fixed-rate mortgages alike. The purpose is to allow borrowers to reduce monthly payments for a period of time. Rather than a monthly payment of $1,200, in which $600 goes to interest and $600 goes to the principal, the monthly payment would only be $600.

The lower monthly payments during the interest-only period are good for households with irregular income such as commission payments less frequent than monthly, or households with unpredictable income, like that of a business owner who is expecting low income while the business is in a period of growth.

Interest-only payment options also allow borrowers to “afford” a more expensive home. This can be important for an executive who needs to entertain clients at home and its appearance is crucial to career success, but there could be a strong desire to use the lower payments to buy a home beyond the means of the borrower.

This is a dangerous prospect, especially in an environment where we can’t be sure whether the value of the house will rise in the short term. While making interest-only payments, the borrower is not building equity in the house. if the borrower is not building equity, the concept is similar to renting, particularly if home values are stagnant or decline. The amount you owe on the mortgage will never decrease. Even worse, some interest-only payments don’t cover the full amount of interest due each month. The excess, non-paid interest would then be tacked onto the principal, causing the borrower to owe more in principal than the home was worth when purchased.

When house values are declining, like they have been in many areas of the United States, this problem is compounded. Not only does the borrower owe the full purchased value of the house while making the interest-only payments, but the house’s declining values means the borrower will quickly owe more than the home is worth. Then, if it is sold, the borrower could owe more money to the lender than he received in the sale.

Interest-only payment options don’t last forever. After the interest-only period ends, the lender will expect the borrower to start paying back the principal. This can result in a significant increase in the number written on the checks sent to the lender. If the income hasn’t increased as expected or if the business has not moved past the “growth” stage, the new payment — a larger payment than you would have had throughout the life of the mortgage if the interest-only option was not selected — might be unaffordable.

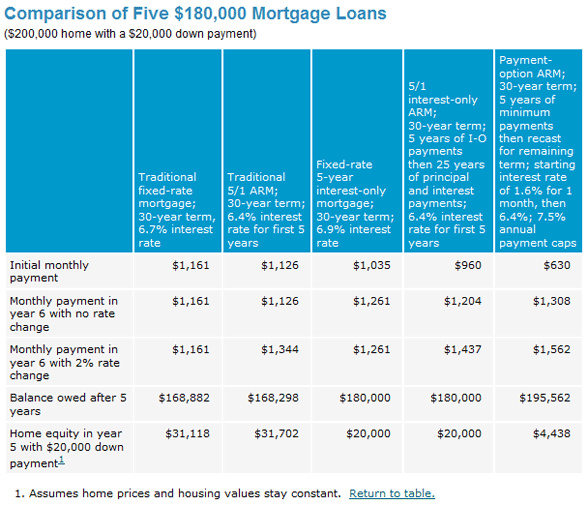

The Federal Reserve Board has a helpful comparison chart outlining the differences in payments you might expect if you choose an interest-only payment option, reproduced below. Notice how low the equity is in the last column, identifying borrowers who opt for the interest-only method.

Do you have or have you had an interest-only payment option on a mortgage? Please share your experiences or opinions.

The Consumerism Commentary Podcast is in full swing with new episodes every Sunday. Listen and subscribe now!

Pros and Cons of Interest-Only Mortgage Payments

Read more of Pros and Cons of Interest-Only Mortgage Payments…

No comments:

Post a Comment